Bagley Risk Management Solutions: Your Shield Against Uncertainty

Bagley Risk Management Solutions: Your Shield Against Uncertainty

Blog Article

Exactly How Animals Threat Security (LRP) Insurance Policy Can Protect Your Animals Investment

In the world of livestock financial investments, mitigating dangers is paramount to ensuring monetary security and growth. Livestock Threat Protection (LRP) insurance coverage stands as a trusted guard versus the unforeseeable nature of the marketplace, providing a strategic strategy to securing your assets. By diving into the complexities of LRP insurance and its multifaceted benefits, livestock producers can fortify their investments with a layer of safety that transcends market variations. As we check out the world of LRP insurance policy, its role in safeguarding livestock financial investments becomes progressively evident, guaranteeing a path towards lasting economic strength in an unpredictable industry.

Comprehending Livestock Danger Defense (LRP) Insurance Coverage

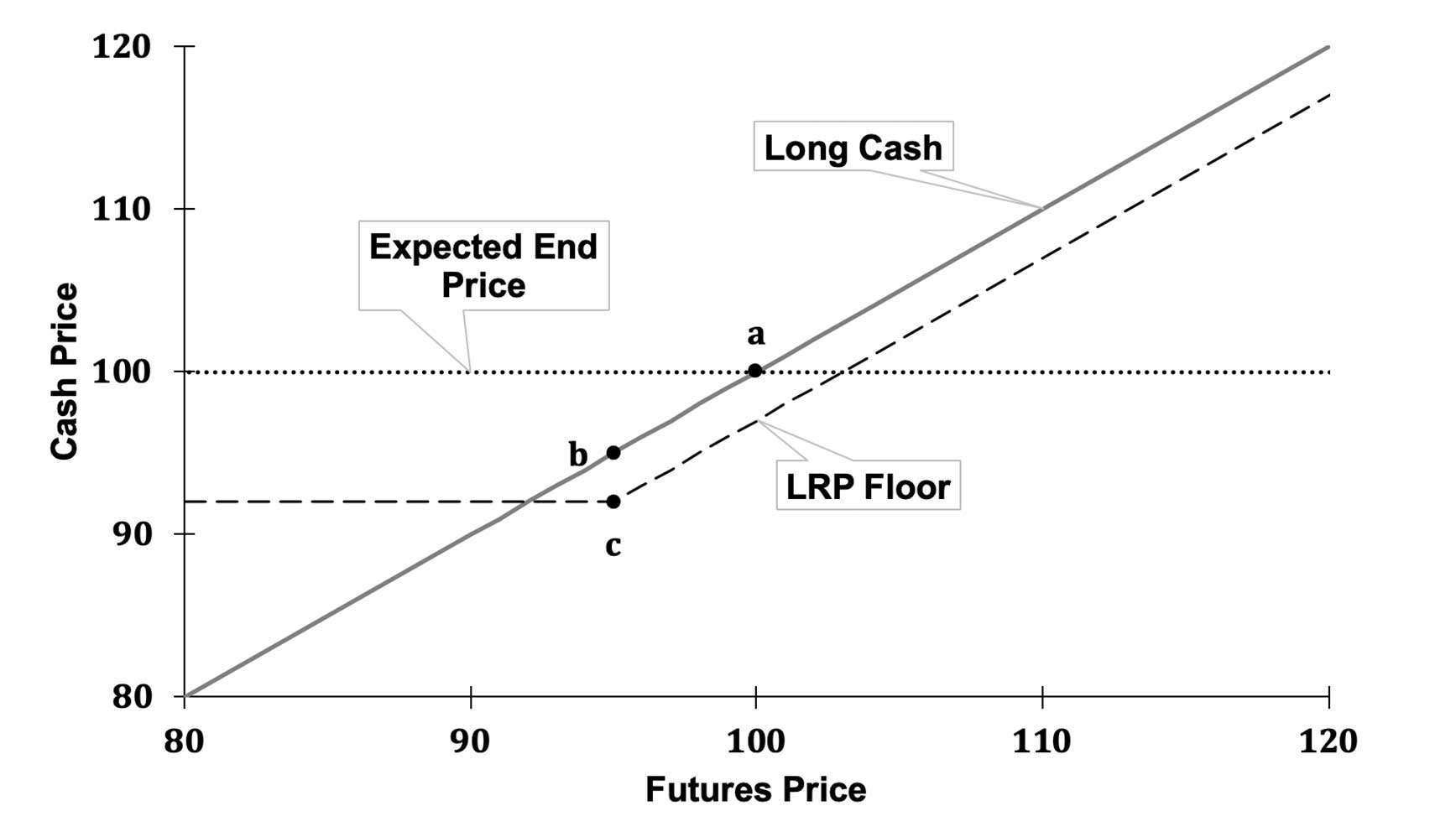

Recognizing Animals Danger Protection (LRP) Insurance policy is essential for livestock manufacturers looking to alleviate monetary threats connected with price changes. LRP is a federally subsidized insurance product created to shield manufacturers against a decrease in market costs. By providing insurance coverage for market price decreases, LRP assists producers secure a floor cost for their animals, making sure a minimal level of income no matter market changes.

One trick element of LRP is its adaptability, permitting producers to tailor coverage degrees and plan lengths to suit their certain needs. Producers can select the variety of head, weight range, insurance coverage price, and protection duration that align with their production objectives and take the chance of tolerance. Comprehending these personalized alternatives is important for manufacturers to properly manage their cost threat direct exposure.

Moreover, LRP is offered for different animals types, including cattle, swine, and lamb, making it a functional risk administration tool for animals producers across various industries. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened choices to guard their investments and guarantee monetary stability when faced with market uncertainties

Benefits of LRP Insurance for Livestock Producers

Livestock manufacturers leveraging Animals Risk Defense (LRP) Insurance obtain a calculated advantage in securing their investments from rate volatility and securing a secure financial footing among market uncertainties. By establishing a flooring on the rate of their animals, producers can minimize the threat of considerable financial losses in the occasion of market slumps.

In Addition, LRP Insurance policy offers producers with peace of mind. On the whole, the benefits of LRP Insurance coverage for animals producers are significant, using a beneficial device for handling risk and making certain financial security in an uncertain market environment.

Exactly How LRP Insurance Mitigates Market Threats

Reducing market risks, Livestock Threat Security (LRP) Insurance policy gives animals producers with a trusted guard against cost volatility and economic uncertainties. By offering defense against unexpected price drops, LRP Insurance policy helps manufacturers protect their investments and preserve financial stability despite market fluctuations. This sort of insurance allows livestock manufacturers to lock in a rate for their pets at the beginning of the policy duration, making sure a minimum price level no matter of market modifications.

Actions to Safeguard Your Livestock Investment With LRP

In the realm of farming risk management, implementing Animals Threat Protection (LRP) Insurance coverage involves a calculated procedure to secure financial investments against market variations and uncertainties. To protect your animals investment properly with LRP, the primary step is to analyze the particular threats your procedure encounters, such as cost volatility or unexpected weather occasions. Recognizing these risks permits you to figure out the insurance coverage level required to protect your investment sufficiently. Next off, it is vital to study and choose a trustworthy insurance coverage copyright that uses LRP policies customized to your animals and organization requirements. Thoroughly evaluate the policy terms, conditions, and coverage limits to guarantee they align with your risk management objectives once you have picked a service provider. Furthermore, consistently keeping an eye on market trends and readjusting your insurance coverage as needed can assist optimize your defense versus potential losses. By following these actions carefully, you can improve the safety and security of your livestock financial investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Safety And Security With LRP Insurance Policy

Guaranteeing sustaining monetary stability with the utilization of Livestock Threat Security (LRP) Insurance policy is a prudent long-lasting method for agricultural producers. By incorporating LRP Insurance Bonuses into their risk administration plans, farmers can guard their livestock investments versus unforeseen market changes and unfavorable occasions that could endanger their economic health with time.

One key advantage of LRP Insurance policy for long-term financial protection is the satisfaction it provides. With a reputable insurance coverage plan in area, farmers can minimize the monetary dangers related to unstable market conditions and unexpected losses due to web link aspects such as illness break outs or all-natural disasters - Bagley Risk Management. This stability enables manufacturers to concentrate on the day-to-day procedures of their livestock business without consistent fear about potential monetary problems

Moreover, LRP Insurance policy supplies an organized technique to handling danger over the lengthy term. By establishing specific insurance coverage degrees and selecting suitable recommendation durations, farmers can tailor their insurance coverage prepares to line up with their monetary objectives and run the risk of resistance, making sure a secure and sustainable future for their animals procedures. In verdict, spending in LRP Insurance policy is a positive technique for agricultural producers to achieve enduring financial safety and security and shield their livelihoods.

Verdict

In final thought, Livestock Threat Protection (LRP) Insurance is a valuable device for animals producers to reduce market risks and safeguard their financial investments. It is a sensible choice for protecting livestock financial investments.

Report this page